Quickbooks ProAdvisor Services

Initial Setup Fees

Simple Start

$500

- Setting up Company Profile

- Setting up Bank Feed

- Creating Banking Rules

- Reconciling Bank Transactions

- Setting Up Chart of Accounts

- Training on managing transactions through the Bank Feed

Essentials

$800

- Includes everything in Simple Start.

- Setting up Customers and Vendors.

- Fixed Assets and Long Term Liabilities.

- Creating Recurring Depreciation Journals.

- Creating Long Term liability amortization schedules.

- Training on invoicing Customers and inputting Vendor Bills

Plus

$1200

- Includes everything in Essentials

- Setting up location and class tracking

- Setting up Projects

- Training on how to manage Location and Class Tracking

- Training on managing Projects

Advanced

$1700

- Includes everything in Plus

- Inventory Setup

- Workflow Creation

- QB Advance Training

Monthly Bookkeeping

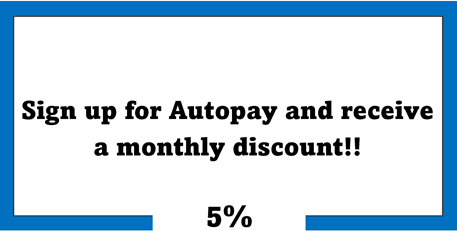

Hourly and Flat Rates

- Call for Quote

- Bank Feed Management

- AP/AP Management

- Reconciliations

- Monthly Reports

Already Have QuickBooks But Need Training?

Contact us to schedule your personalized virtual training session.

Follow the below link to learn more about Quickbooks Online Subscriptions. A 15% discount for the life of the subscription is available for New Quickbooks Customers

Tax Preparation and E-Filing Services

Individual Taxes

$175

- Form 1040 and accommodating schedules and forms (does not include Schedule C)

- Includes 1 State Return

Individual w/Schedule C

$250

- Form 1040 with accommodating schedules and forms

- Profit/Loss from Business (Schedule C)

- Includes 1 State Return

S-Corporation and Partnership

$350

- Form 1065 or 1120S and accommodating schedules and forms

- K-1 schedules for each owner/partner

- Includes 1 State return

Corporation

$550

- Form 1120 and accommodation schedules and forms

- Includes 1 State return

Not-for-Profit

$350-$550

- Form 990 or 990EZ

Additional Tax Services

- State/Local Returns (per State/Local) – $20

- Sales and Use Tax – $75/month or $225/quarter

- Fuel Tax Filing – $225/quarter

- 1099/1098 Filing (10 forms) – $25

- Annual Report Filing – $125/year

- Offer-in-Compromise – $1600

Other Services

Business Start Up

Starting at $750

- Federal and State Identification applicaton

- Payroll withholding and unemployment insurance application

- Assistance with applying for business licenses

- Creation of Company By-Laws and Articles of Incorporation

501(c)(3) Filing

- Preparation and Filing of form 1023EZ (short form) – $875 includes all fees

- Preparation and Filing of form 1023 (long form) – $1800 includes all fees

Advisory Services

$300 Retainer (Annual Fee)

*This will be billed to clients who have not subscribed to Monthly Bookkeeping

Retainers will be utilized in 30min increments at the hourly rate of $60/hr.

Any remaining Retainer on account can be utilized toward the upcoming tax season or carried over into the following year!!!

Retainers are non-refundable.*

- Quickbooks Training Material

- Coaching/Email Support

- Phone/Zoom Discussions

Additional Services

- KPI’s Tailored to your business

- Notary Services – $10/signature

- Financial Statement Reviews – $75

- Historical Cleanup – $60/hr